Google Tez App: How to Use, Features & Privacy

Google Tez, the Internet search giant’s first UPI-enabled digital payments app launched in India. Catering to an audience looking for digital payment solutions. You can choose between popular apps like Paytm, PhonePe, the NPCI’s BHIM app, and a range of UPI apps from different banks in the country.

Analysis of the Google Tez app: What it can to do, to how to use it.

The Google Tez app is is a medium to facilitate bank transactions between the sender and the receiver. It isn’t a digital wallet service like Paytm, but is instead like other UPI apps, such as PhonePe.

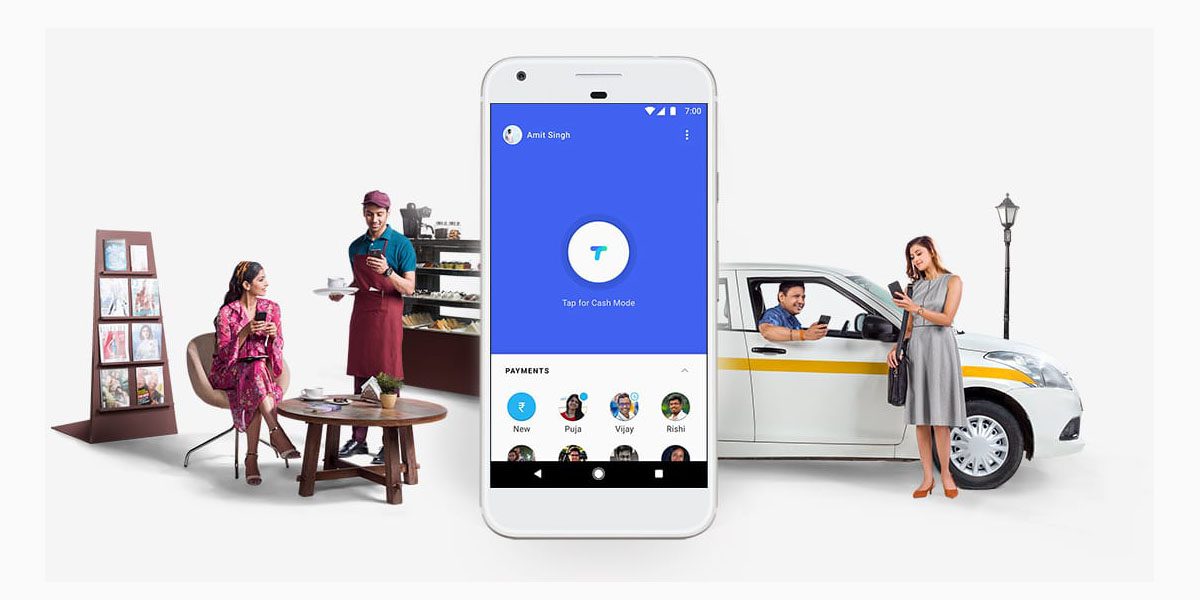

Tez App

The Google Tez app’s download size is pretty low at 8MB, but it is still large compared to PhonePe (4.26MB) and BHIM (2.99MB). The app expands to over 20MB on the phone after installation, a size that shouldn’t cause much of an issue. Pretty reasonable. On iOS, it’s significantly bigger, with a download size up to 54.6MB. When setting up the app, users are shown a language selection. It asks you for your mobile number that is paired with your bank account – you are then asked to provide permissions. We also found that the Tez app links this to the Google account signed into the phone, on both Android as well as iOS. You do have the option to link a different account, but a Google account is mandatory for the app to work.

Once you enter the number and verified by an SMS OTP, you are given the option to set up a Google PIN or use the current screen lock method on the phone. You are then asked to select your bank from a list to link it for UPI transactions. For instance, using a Kotak Mahindra account we were assigned a “@okaxis” VPA but pairing it with an ICICI account resulted in an “okicici” VPA. When trying out the app, we did face difficulties when adding the bank account in Tez, though a couple of tries seemed to solve the issue. After these steps are complete, you’re good to go.

Competition Apps (Similar Apps)

The first screen when the Google Tez loads up is pretty basic, has offers limited functionality when compared to PhonePe and BHIM. PhonePe gives you additional options like paying your utility bills through the app, while BHIM has simpler Send, Request, and Scan & Pay options – the last being for QR codes. Making payments using the Google Tez app is easy, as it needs just a tap to select the recipient. The app also lists other Tez users from your phonebook for a faster process.

Swiping down on the first screen in the Google Tez app will give you access to “Cash Mode”, which lets you transfer money without having the recipient’s phone number or needing to share your own – useful in the case of transactions at a shop or another business. For this, the user transmits audio using Google’s Audio QR (AQR) technology to identify the recipients phone near you. We tried this feature and it worked as advertised even in a noisy environment. But we must say that it took longer than expected.

Earn Money

Google is offering users Rs. 51 for referring new users to use the app. We received Rs. 69 for a Rs. 100 transaction which instantly credited to the bank account. You can earn a maximum of 10 rewards per week, up to a total of Rs. 9,000 per financial year.

After the initial hiccups the Google Tez app seems to be working reliably. The app works as expected and the Cash Mode feature does look promising. However in comparison, the PhonePe app looks more useful as it lets you pay your utility bills and other stuff. But if basic money transfer is what you need, the BHIM app still works just fine.